Moody’s rating agency has said that prolonged political uncertainty in Algeria will undermine growth prospects and weigh fiscal and international imbalances

On 26 March, the chief of staff of the Algerian army, Lt General Ahmed Gaïd Salah, called on the constitutional council to initiate the removal proceedings against President Bouteflika on the grounds that he was unable to carry out his duties.

This announcement follows the president’s promise to re-draft the constitution and oversee a transition period following weeks of peaceful protests.

“The more protracted the political transition the greater risk posed to Algeria’s credit profile,” said Elisa Parisi-Capone, vice-president and senior analyst at Moody’s.

Moody’s report highlighted vital points:

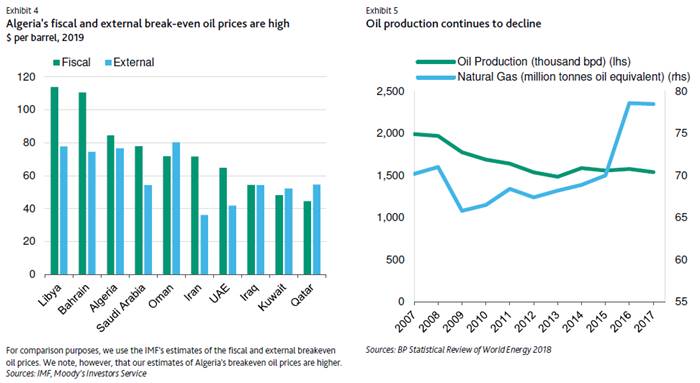

-Like other more exposed oil producers in the region such as Libya, Bahrain and Oman, Algeria is vulnerable to swings in oil prices.

-Its current account and fiscal deficits have widened because its persistently high fiscal and external oil breakeven prices continue to exceed our expected US$50-70 medium-term projection range.

-At the same time, declining production related to postponed investment projects is starting to weigh on growth; protracted political tensions are likely to exacerbate this slowdown.

-Together with a continued drawdown of financial buffers, this is denting the sovereign’s shock-absorption capacity.

Algeria lacks fiscal space to further loosen fiscal policy. Its fiscal deficit ballooned to over 15 per cent of GDP during the 2015 oil price shock from 0.4 per cent of GDP in 2013, the report added.

Algeria lacks fiscal space to further loosen fiscal policy. Its fiscal deficit ballooned to over 15 per cent of GDP during the 2015 oil price shock from 0.4 per cent of GDP in 2013, the report added.

Moreover, the government depleted its sovereign wealth fund in 2016 and can no longer rely on the central bank deposits of public sector companies, as most have been weakened by unfavourable conditions in the oil industry. With limited funding options given Algeria’s reluctance to contract external borrowing, the government relies on central bank financing to cover its financing needs.