The Oman budget deficit is expected to remain around nine per cent of the gross domestic product (GDP) in 2019, according to Moody’s Investors Service

In early January, Oman (Baa3 negative) published its 2019 budget. The plan envisages a small nominal improvement in the fiscal position relative to the 2018 budget.

The rating agency said the Oman Budget 2019 does little to stabilise public finances and reduce vulnerability to oil prices.

The agency added that the country’s budget plan contains few significant new measures to reverse Oman’s fiscal deterioration, stabilise its debt dynamics, and reduce its vulnerability to potential declines in oil prices.

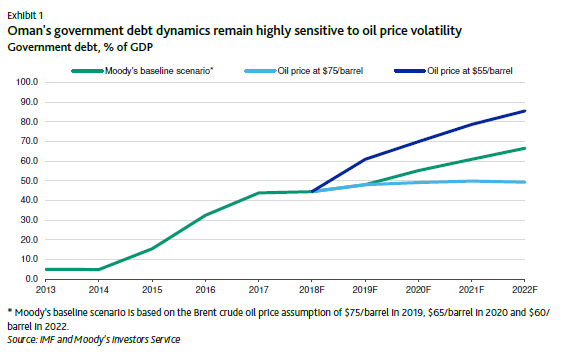

“We expect that Oman's fiscal deficits will remain sizeable over the next several years, leading to a further increase in the debt-to-GDP ratio to above 60 per cent by 2021 from around 44.5 per cent in 2018, although planned state asset sales, if successfully executed and directed to finance the budget deficit, could slow this pace somewhat,” Moody’s stated.

“We expect that Oman's fiscal deficits will remain sizeable over the next several years, leading to a further increase in the debt-to-GDP ratio to above 60 per cent by 2021 from around 44.5 per cent in 2018, although planned state asset sales, if successfully executed and directed to finance the budget deficit, could slow this pace somewhat,” Moody’s stated.

It added that the country maintains a comparatively robust government balance sheet, including US$22.2bn (27 per cent of GDP) of wealth fund assets as of June 2018.

This, together with long maturities in government debt, demonstrated access to market financing and high per capita income levels, will support the sovereign’s creditworthiness and provide some flexibility for fiscal adjustment in the coming years, the report noted.

However, in the absence of new policy measures, Oman’s deteriorating debt dynamics will remain highly sensitive to oil prices, which we believe could fluctuate between US$55 and US$75 per barrel in the medium term.

It further added that the budget is based on an average oil price of US$58 per barrel. The 2019 budget forecasts a fiscal deficit of US$7.3bn, or around 9 per cent of GDP, for this year.

Historically, Oman’s large fiscal imbalances have been the main driver behind the country’s large current account deficits. Although last year’s increase in oil prices led to a significant improvement in Oman’s trade surplus, which rose to US$11.5bn in the first nine months of 2018 from $3.5 billion during the same period of 2017.

The volatility in oil prices since October 2018 has once again highlighted Oman’s fiscal and external vulnerabilities, which the agency estimates to be more than US$90 per barrel in fiscal and external oil prices.