Fuelled by increasing day rates and growing global demand growth for harsh environment (HE) semi-submersible offshore drilling rigs, some industry leaders are extremely bullish on future demand for these semis, according to IHS Markit, a leading global source of critical information and insight

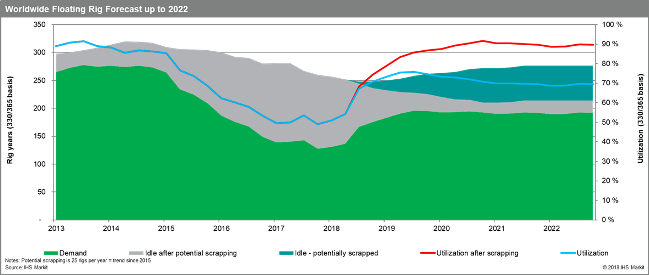

According to the IHS Markit Floating Rig Report and IHS Petrodata RigPoint database, average new fixture day rates for all floating rigs climbed by 12 per cent year-over-year through September 2018, and the average expected annual growth in global demand for the floating rigs is seven per cent through 2022, but the floater market utilisation is far from tight at just 48 per cent.

“Day-rates for HE semis increased 25 per cent year-over-year based on third-quarter 2018 rates versus third-quarter 2017, while rates for all other floating rigs have only increased three per cent during the same period, so we are seeing positive growth in the HE semis market, but we are far from a boom,” said Erik Simonsen, associate director, upstream consulting at IHS Markit.

“There are two major points of distinction to be made relative to the market demand for these HE floaters. First, there is no shortage of HE floaters - the industry is oversupplied and global utilisation for HE semis is comparable to other floating rigs - far below the 80 per cent that would be considered a boom or tight market. Second, not all rigs are created equal and we are seeing significantly higher utilization and day rates for the more modern HE semis, which are much more efficient than the older HE floaters, so companies are willing to pay a premium for those more efficient rigs,” Simonsen said.

“The most modern HE floaters have seen an average year-over-year growth (3Q 2017 to 3Q 2018) in day rates of 33 per cent compared to increased rates of just 4 percent growth for older HE floaters, so there is a huge difference in day rates and demand, depending on the age and capability of the rig,” Simonsen said.

“The risk is that when some contractors start to order new rigs, other contractors might stop planned scrapping of their old rigs with the thinking that, even if newer rigs are generally more efficient, there could also be demand for their older floaters. If contractors follow this approach, it would most likely delay the market upturn beyond 2022,” Simonsen said.

The Brent oil price has recently dropped 30 percent to $60 per barrel and the present price is below the forecasting price in the IHS Markit Floating Rig Report. This significant oil price decline emphasizes the importance of attrition for the less-efficient rigs even though the oil price is volatile and might recover, Simonsen said.

“Despite increased oil prices in the past year and a boost in operator cash-flows, according to our IHS Markit analysis, we expect E&P spending growth to be disciplined,” Simonsen said.