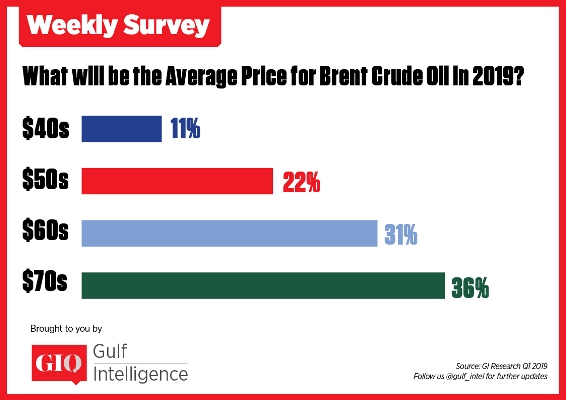

Brent Crude oil, which collapsed 40 per cent in Q4 2018 to almost hit a floor of US$50 a barrel, will recover this year and average above US$60 a barrel

The above statement is according to two-thirds of the 100 energy industry executives polled in a Gulf Intelligence curtain raiser survey conducted ahead of the January ninth UAE Energy Forum.

The coalition of 25 OPEC and non-OPEC states, which came together for the first time in late 2016 to slash global oil supplies in order to reverse a three-year oil price slide, agreed last month to once again cut their collective output by 1.2 mmbbl a day in 2019 which should be sufficient to keep oil prices above US$60 a barrel this year, according to 74 per cent of those surveyed in the GIQ survey.

Suhail Al-Mazrouei, UAE Minister of Energy and Industry, told Gulf Intelligence in a recent interview, “Market dynamics will always change, and we are used to that. Maybe the pace of fluctuation was higher in the past weeks, but that is driven not only by market fundamentals; it’s driven as well by geopolitics, trade wars, sanctions and many other things.”

China and the US agreed to a ceasefire in their trade war at the G20 summit in Argentina at the end of November 2018 after high-level talks between US President Donald Trump and Chinese President Xi Jinping, yet only 39 per cent of the GIQ survey respondents believed this détente would signal the end of the spat even though the world’s two biggest energy importers had agreed to abandon plans to escalate tariffs on 1 January.

The OPEC+ agreement will extend through the first half of 2019 until the oil exporters group meets again in June. While six months may be enough to reduce the combined output of OPEC and its partners by the agreed 1.2mn bpd, if US production continues to grow at the current rate, it would likely offset this cut completely.

The US production of shale oil, which has added 5 mmbbl of oil to US output over the last decade to move America onto a similar level as Saudi Arabia and Russia at around 11 mmbbl a day, has put consistent downward pressure on oil prices in recent years.