The Middle East remained the world’s largest oil-producing region in 2016, according to BP’s newly released BP Statistical Review of World Energy 2017

Oil production in the region grew by 5.7 per cent, driven by increases in Iran (+700,000 bpd), Iraq (+430,000 bpd) and Saudi Arabia (+430,000 bpd), where production reached record levels. Oman also recorded record production.

The Middle East accounted for all of the growth in global crude exports and nearly half the increase in refined product exports. Crude exports rose by 1.6 mn bpd while (gross) product exports grew by 450,000 bpd. The Middle East made up 46 per cent of global crude oil exports and 17 per cent of refined product exports. The main destination for Middle East oil exports was the Asia Pacific region, which accounted for 73 per cent of the total.

Middle East natural gas production grew by 3.3 per cent, led by Iran and Saudi Arabia. Middle East LNG exports increased by 1.9 Bcm (+1.3 per cent) driven by an increase from Qatar, the world’s largest LNG exporter.

Natural gas remained the region’s leading fuel; its share of total consumption hit a record 51.5 per cent. Renewables in power generation grew by 42 per cent, reflecting the global trend, but accounted for just 0.1 per cent of primary energy consumption in 2016.

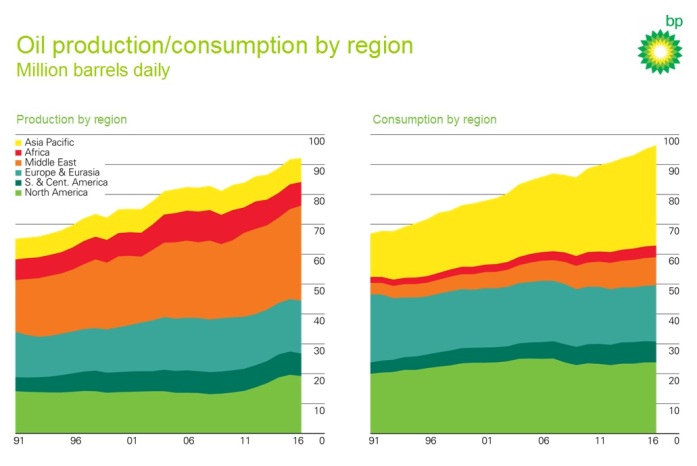

The Review highlights the long-term transitions now underway in the global energy markets, with a shift to slower growth in global energy demand, demand moving strongly towards the fast-growing developing economies of Asia, and a marked shift towards lower carbon fuels as renewable energy continues to grow strongly and coal use falls, contributing to a flatlining in carbon emissions.

At the same time, energy markets are adjusting effectively to nearer-term challenges, with the oil market, in particular, adjusting in 2016 to the oversupply that has dominated the market in recent years.

Bob Dudley, BP Group Chief Executive, said, “Global energy markets are in transition. The longer-term trends we can see in this data are changing the patterns of demand and the mix of supply as the world works to meet the challenge of supplying the energy it needs while also reducing carbon emissions. At the same time, markets are responding to shorter-run run factors, most notably the oversupply that has weighed on oil prices for the past three years.”